Gemini Derivatives

Gemini Derivatives

Gain exposure to crypto with perpetual contracts

A Non-US Crypto Derivatives Platform. Gemini Derivatives is available in select jurisdictions globally. It is not currently available in the US, UK, or EU.

All Payment Token or Crypto Derivatives products or offerings are provided by Gemini Artemis Pte. Ltd. Please click Important Notice for more information.

Gemini Derivatives by the numbers

Current Gemini derivative spreads, trading volumes, and more.

New Feature

Indices: Access the Crypto Market with Confidence

Powered by Kaiko: The Trusted Benchmark Administrator

Diversification Made Simple

Invest in baskets of crypto assets grouped by market themes, reducing exposure to single-asset volatility.

Kaiko’s Trusted Data

Ensures independence and transparency in index calculation.

Frequent Rebalancing

Quarterly updates keep the indices aligned with market developments while limiting unnecessary turnover.

Regulatory Compliance

Fully aligned with IOSCO and BMR standards, offering peace of mind to institutional investors.

For methodology and compliance details, explore the .

For methodology and compliance details, explore the .

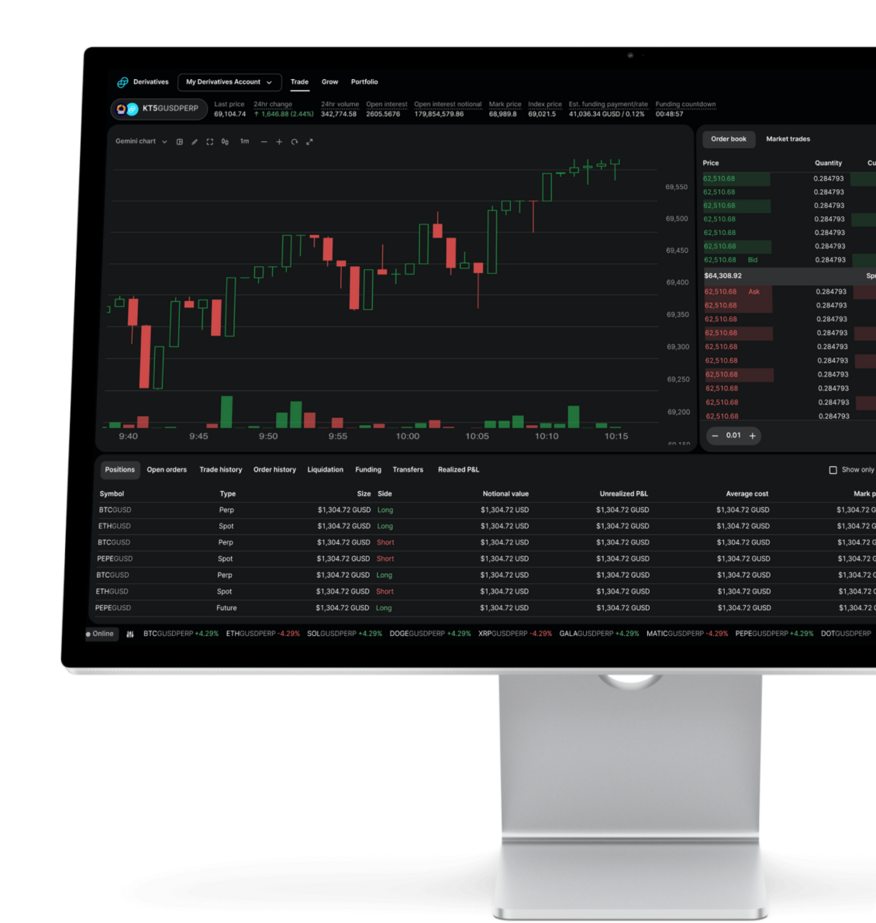

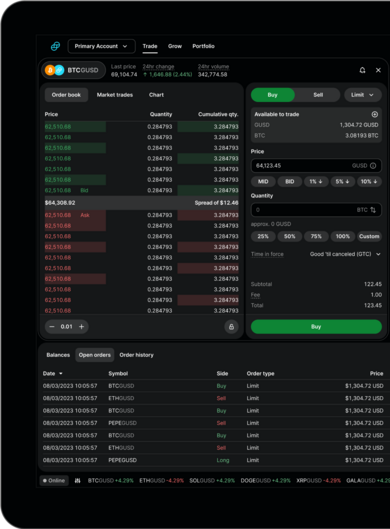

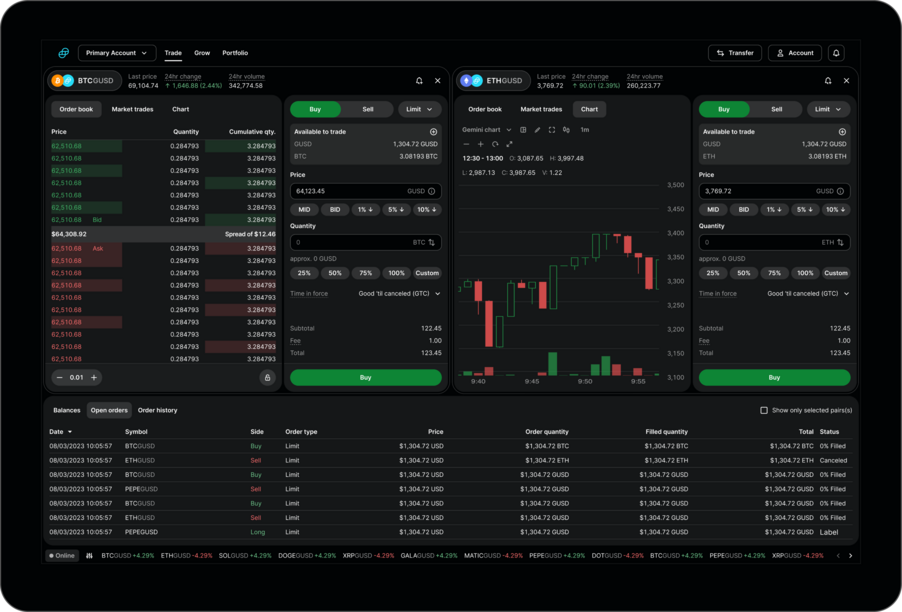

Elevate your trading strategy

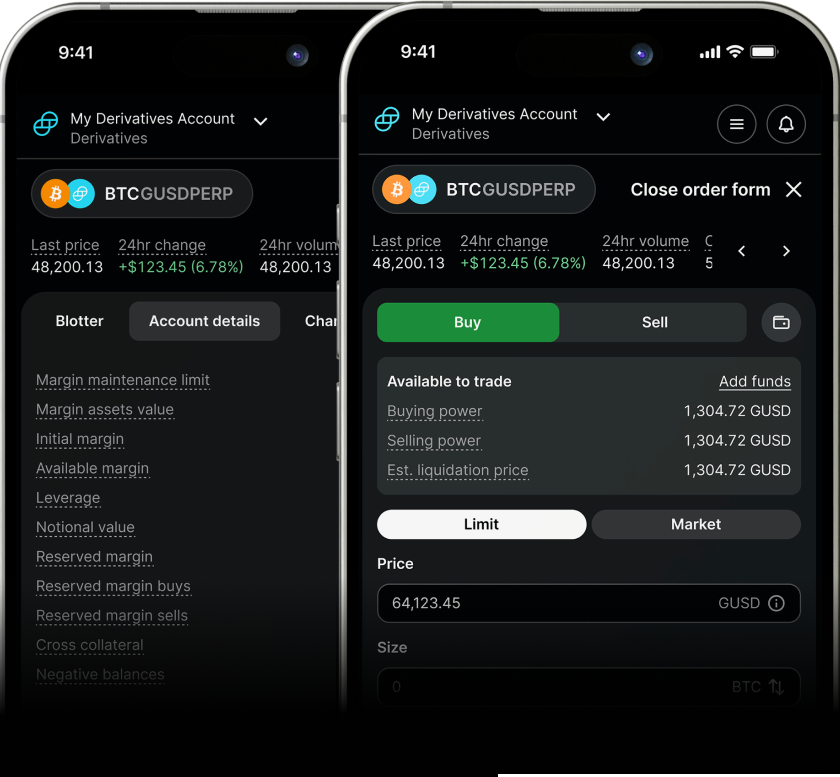

Gain directional exposure by trading perps with no expiry and utilize cross collateralization for more flexibility and maximum capital efficiency.

Execute trades in microseconds using our trading pair selectors and deep order book visibility to make the most of market opportunities.

Manage risk with confidence

Safeguard your investments in our secure ecosystem, navigating uncertainty effectively.

Up to

100x

leverage

Capitalize on market opportunities and generate returns by trading on margin with up to 100x leverage.

Crypto Derivatives 101

Crypto Derivatives 101

No expiry date

A perpetual contract is similar to a crypto futures contract with one key difference - there is no expiry date. Traders can hold a position open as long as their margin is sufficient.

Custody-free exposure

Perpetuals derive their value from the underlying asset, meaning traders can gain exposure to a crypto asset without having to hold it.

Trade long or short

Traders can long or short perpetual contracts, allowing them to benefit from prices moving both directions.

Cross Collateral

With cross collateral you can use other assets than GUSD, such as BTC, as collateral for your derivative trades.

How to start trading derivatives

Resources

The trusted crypto-native finance platform